Think Women Entrepreneurs

Were Snubbed Before COVID-19?

The Gender-Focused Funding Gap Is Drastically Widening …

That Needs To Change!

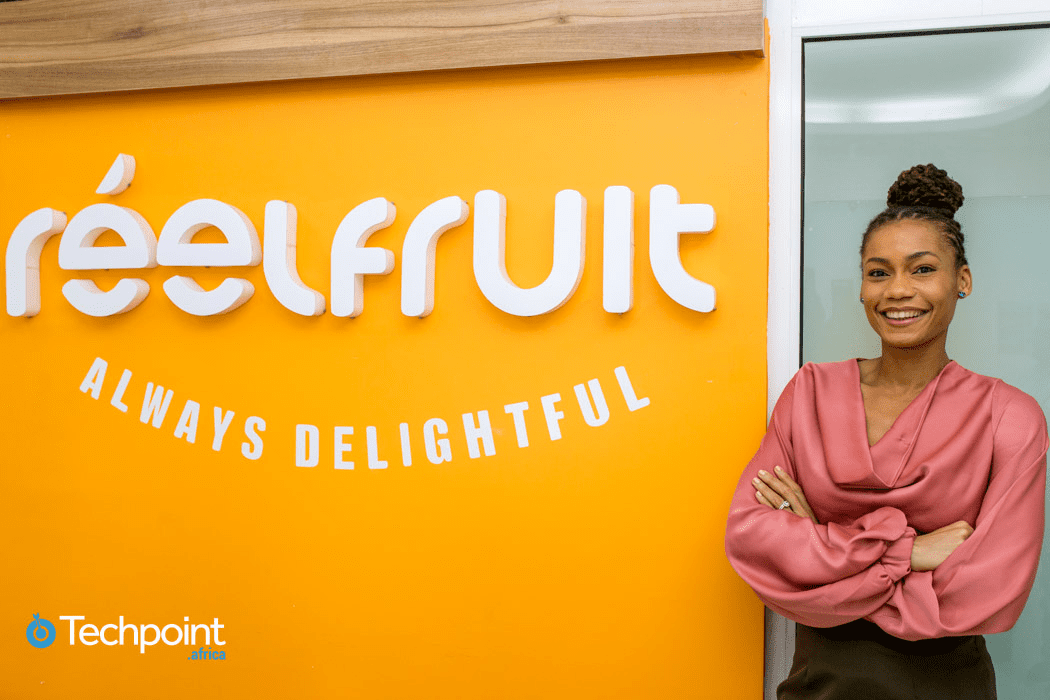

Affiong Williams was on the cusp of a monumental feat for a young Nigerian entrepreneur: a $3 million Series A round.

Then COVID-19 hit. The machinery she needed to ramp up production at her dried-fruit and nut snack company — ReelFruit — was stuck outside the country; Nigeria’s borders were closed; and the capital she needed was regrettably on hold. There were opportunities for the company to diversify its revenue base to better ride out the pandemic but only if some funding could be secured in the short-term.

A bank loan was not a feasible option, and most funders were not looking at new investments. But my impact investment firm, Samata Capital, saw the potential for a great investment in ReelFruit and organized the bridge capital the company needed. As Affiong and ReelFruit waited for the Series A round — and for the world to emerge from lockdown — we did not want her to fall behind as she built her ever-growing global agribusiness company.

We didn’t see this opportunity as a risk, but rather an investment, for several important reasons:

- High-Quality Product: We love ReelFruit’s products, particularly its “gently dried” mango. I’d first seen the snacks in a Lagos grocery story about six years ago. West-African mangos are some of the sweetest in the world and don’t require any added sugar. Sweetened coconut flakes, a fruit and nut mix, salted cashews and dried pineapple are some of the other snacks in the lineup from ReelFruit, which has single-handedly built the healthy snack food category in Nigeria. The company went from being stocked in one grocery store to being on the shelves in more than 500 in just a few years. Some may say the global snack food segment is crowded but ReelFruit’s ability to capture a significant market like Nigeria while building an internationally recognized brand demonstrates a superior product.

- Robust Traction and Growth: The company had a solid track record with continual growth over the last eight years. It was making savvy decisions, listening to the market, introducing new products, and opening new product lines on a consistent basis. Whatever profits it made was being plowed back into the company to hire more people, expand production, and grow as an internationally known brand.

- Savvy Entrepreneur: The entrepreneur was scrappy, smart, and ambitious. A marathon runner who saw how Nigeria lacked healthy snack options, 35-year-old Affiong started the company in 2012 in her bedroom with just $8,000 of her own savings. She raised money from friends and family; went on to win business competitions including one in Europe; and was one of 10 emerging market agribusinesses to share $1.2 million in Feed the Future Funds from the U.S. Agency for International Development (USAID).

Affiong started the company in 2012 in her bedroom with just $8,000 of her own savings.

But the additional reasons we invested is what sets Samata apart …

ReelFruit — a great company with a bright future — was founded and is led by a woman in sub-Saharan Africa that has demonstrated a commitment to diversity, equity, and inclusion (DEI), ensuring that women have equal access to high-paying manufacturing jobs in Nigeria. In fact, ReelFruit has 50% female staff and is an all-female management team. Samata believes that companies incorporating DEI elements into their culture will outperform their peers by recognizing new opportunities faster and identifying potential risks in a more comprehensive way. Such qualities rank high when we are looking at businesses to fund.

It shouldn’t have required a gender-focused investor to help ReelFruit navigate the pandemic. But unfortunately, it did. And we’re grateful we hopped on the opportunity when it arose.

Female-founded companies received a lot less venture funding last year. In fact, such funding through mid-December (2020) dropped 27% globally from the same period back in 2019, offering a chilling view of just how hard 2020 hit women entrepreneurs, according to Crunchbase. This lack of funding likely contributed to higher business closures for women during the pandemic which were 20% higher than for men during the same period.

Furthermore, women entrepreneurs already had too much ground to make up.

By one measure, more than 97% of venture capital funding goes to startups founded by men, even though there is a consistent rise in women-led start-ups across the globe.

This same inequity holds true in sub-Saharan Africa even though the rate of female entrepreneurship on the continent is higher than in any other region.

So how did it all work out?

What does the post pandemic world look like for ReelFruit?

Exports are still below pre-pandemic levels at the moment, but snacking never stopped, allowing ReelFruit to grow the topline by 50% as well as hire 20 more employees, grow their Board of Directors and complete a brand refresh.

This is great progress which will position the company for future growth.

However, as a community of investment leaders we must do better when it comes to finding and funding the world’s diverse and promising companies. As well as to shed light on long entrenched inequities around gender, race, and socio-economic opportunities around the globe. We must ignite momentum for action by the investment community.

There’s a lot of ground to make up so let’s get to work.

Lisa G. Thomas is the Founder and Managing Director of Samata Capital, a gender lens venture fund focused on making private sector investments in fast-growing, scalable businesses in East and West Africa that advances opportunities for women and promotes gender diversity.